Best Ways to Send Money from the USA to Europe

Sending money overseas has become a routine necessity for many individuals and businesses.

Whether you need to support your family, fund education, make international payments for services, or simply send a gift, you’ll find a wide range of money transfer options to Europe from the USA.

In this blog, we take a look at the best ways to transfer money from the USA to Europe to help you choose the most convenient, quick, and affordable method for your needs.

Contents:

The challenges of sending money overseas

What to know before you send

How to transfer money from the USA to Europe

The best way to send money to Germany from the USA

Transfer money to the UK from the USA

Send money from the USA with Fin.do

The challenges of sending money overseas

Despite the variety of transfer options, moving funds across regions can still involve significant friction.

One issue is that unless a bank has branches in both locations (rarely the case across continents), transfers are slow and fees are high.

Transfers from the USA to Europe often take place between banks that may not even have a direct partnership, which requires the involvement of a third-party bank that has agreements with both the sender's and recipient's institutions.

Read more about how the SWIFT payment system works here.

Another challenge is that each region has its own holidays and operates in its timezone, leading to further delays compared to sending money domestically within the USA or Europe.

Lastly, cross-border transfers typically involve a currency exchange - in this case, converting USD to EUR or sometime to local currencies like the Polish złoty (PLN), the Hungarian Forint (HUF), or the Romanian leu (RON).

Certain providers may not support USD transfers outside North America, while others may not support less traded currencies such as RON.

What to know before you send

Before you select a money transfer method, it’s important to understand the key factors that will influence your transfer:

1. Exchange rates

Different providers offer different and varying exchange rates. Even a slight difference in rates can significantly impact the amount of money the recipient gets.

2. Transfer fees

Fees can vary between a fixed fee to a percentage of the amount you’re sending. Some services add a fee for performing the currency exchange.

3. Transfer speed

Bank transfers across continents are particularly slow.

Domestic solutions (such as Zelle or Venmo in the US) do not offer cross-border transfers, and other services may take longer than 48 hours to deliver the funds.

So let’s look at the most common methods to send money from the USA to Europe.

How to transfer money from the USA to Europe

Bank transfers (wire transfers)

Most major banks in the USA allow you to send money internationally to Europe through a SWIFT transfer, also known as a wire transfer.

While these are secure and trusted, banks often charge high fees (which can be as high as $20 to $50) and may offer less competitive exchange rates compared to other services.

In addition, the recipient in Europe may also be charged a fee by their bank to receive the money. Bank transfeers also take several days to complete (especially if the transfer is made before the weekend or during bank holidays).

The main benefits of a bank transfer are that they are generally secure and hence suitable for transferring large sums of money.

Online money transfer services

Digital platforms such as Wise, PayPal, Remitly, or Fin.do are good alternatives to traditional bank transfers.

They typically offer better rates, lower fees, and faster processing times. Here are their main benefits and disadvantages.

Wise

+ offers lower fees than banks

- only supports around 40 currencies

- transfers usually take 1-3 business days

PayPal

+ easy to use, widely available and secure

- has higher transfer fees (5% for international transfers), especially when currency conversion is involved

Remitly

+ low fees for certain delivery methods

- you can only send the local currency at the destination (EUR in Eurozone countries)

OFX

+ competitive exchange rates, no transfer fees above certain amounts

- minimum transfer amount (usually $1000 or more)

Fin.do

+ instant transfers with no fees for currency conversion

+ allows any currency from and to 200 global destinations

Cash delivery (Western Union, MoneyGram)

Cash pick-up options like Western Union or MoneyGram are widely accessible through many physical locations in Europe.

Transfers can be done within minutes, but the fees are generally high, especially for fast transfers, and exchange rates can vary significantly from the mid-market rate.

The best way to send money to Germany from the USA

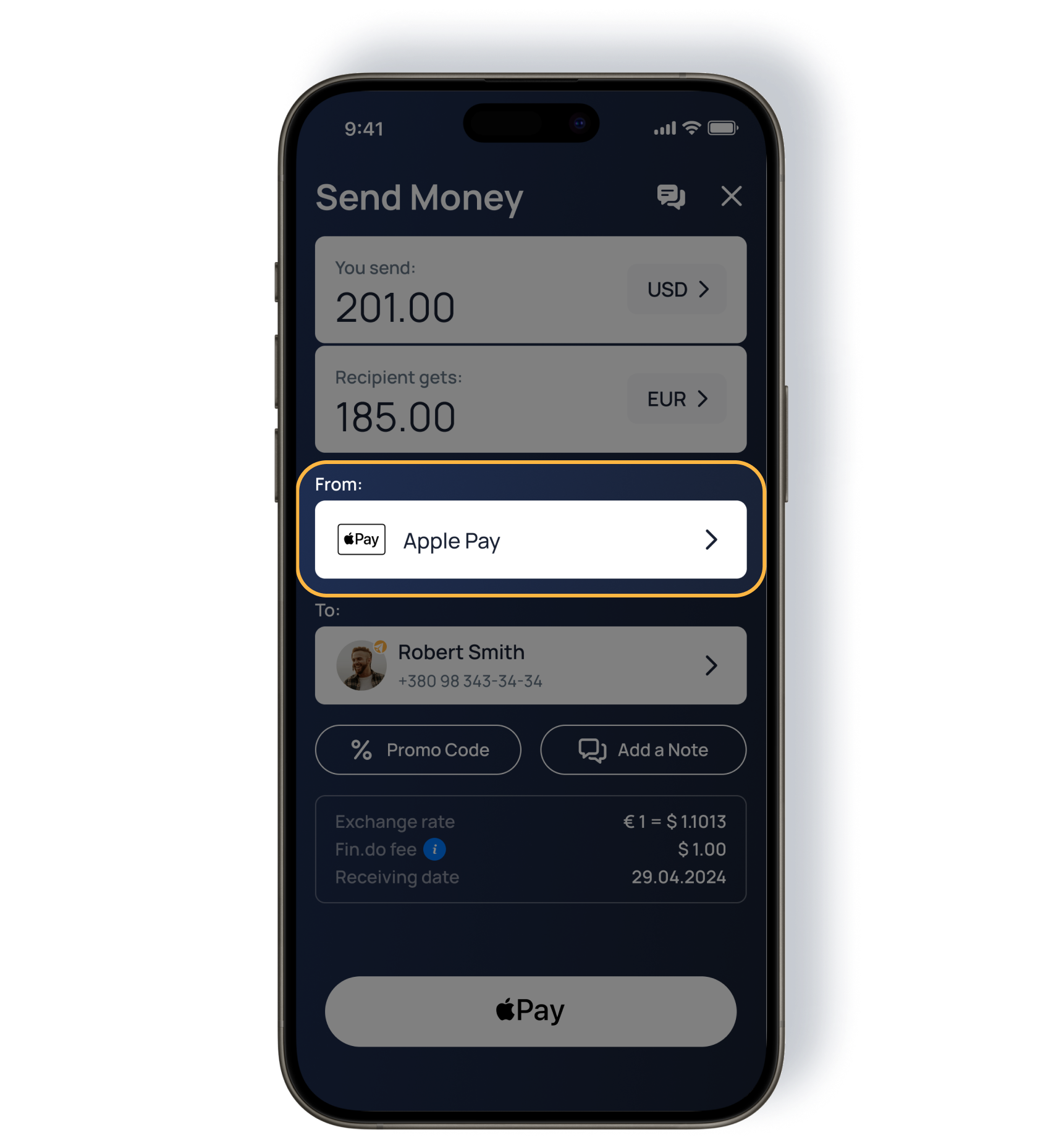

If you need to transfer money from the USA Germany, France, Spain, Italy, or other countries in the Eurozone, Fin.do is the fastest and easiest way to do it.

If you are based in the USA, Google Pay and Apple Pay will appear as your default sending method in Fin.do.

Fin.do lets you send money from any card you add to your Google Pay or Apply Pay wallet.

This means there is no need to manually add card information. Simply make sure you have cards added to your Google or Apple wallet.

Transferring dollars to euros (USD to EUR)

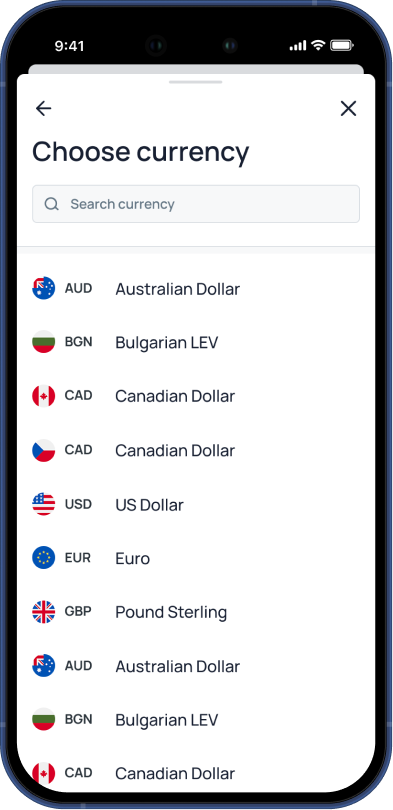

Generally, transfers from the USA to European countries in the Eurozone involve converting US dollars to euros. With Fin.do, you can send any currency to any country.

To send US dollars from the USA to Europe, select USD as the sending currency and EUR as the receiving currency.

You’ll see the currency exchange rate and final fee for your transfer once you confirm the card in your Apple / Google wallet that you’ll be using for your transfer.

Fin.do lets you send money to friends in your agenda, to your cards, or to other people using their 16-digit card number.

Same currency transfers (USD to USD, EUR to EUR)

Fin.do enables cross-border transfers in the same currency regardless of your location or the transfer destination.

For example, you may send USD from the US to USD in Germany, or EUR from the USA to EUR in France.

To send a same-currency transfer, just select the sending and receiving currency you wish to send. If your card or the recipient’s card is issued in a different currency, your bank will perform the currency exchange.

You can read more about same-currency transfers with Fin.do here.

Transfer money to the UK from the USA

When transferring money from the USA to the UK, you’ll generally convert USD to British pounds (GBP). With Fin.do, transfers from the USA to the UK are delivered instantly, regardless of the currency or time of your transfer.

Transfer USD to GBP

To send US dollars from the USA to GBP in the UK with Fin.do, make sure USD is set as the sending currency and GBP as the receiving currency.

You’ll see the currency exchange rate and final fee for your transfer once you confirm which card in your Apple / Google wallet you’ll be using for your transfer.

Fin.do lets you send money to friends in your agenda, to your own cards, or to other people using their 16-digit card number.

Same currency transfers (USD to USD, GBP to GBP)

Fin.do also lets you make transfers in the same currency, regardless of your location or transfer destination.

You can send USD in the UK, or GBP from the USA to the UK. Simply select the sending and receiving currency for your transfer.

If your card or the recipient’s card is issued in a different currency, the bank will perform the currency exchange.

Learn more about same-currency transfers with Fin.do.

Send money from the USA with Fin.do

Sending money from the USA to Europe (or other regions) only takes a few minutes. Here is how to make your first transfer to Europe with Fin.do.

1. Create a Fin.do account

If you’re new to Fin.do, download the mobile app on your Android or iOS device. Signing up for an account takes a minute and you only need to provide your phone number and email address.

2. Set up your transfer

In the USA, Google Pay and Apple Pay will appear as your default sending method. You only need to add the details of the transfer:

- Enter the amount to send;

- Select a sending currency;

- Select the recipient currency;

- Add or select a recipient (your card, friends, or a 16-digit card number);

- Tap Google Pay or Apple Pay to continue. You can choose to change the card in your wallet or add a new one at this step;

- Hit Continue to proceed with the transfer;

- Review your transfer details, including the final fee, before confirming your transfer

3. Track your transfer

Fin.do allows you to track the status of your transfer at all times as well as to download a transaction receipt.

Most transfers Fin.do are delivered to your recipient’s card within minutes.

Benefits of transferring money from the USA with Fin.do

While there are many ways to transfer money from the USA to Europe, Fin.do provides several benefits over conventional transfer services.

Send any currency anywhere

Fin.do offers unparalelled flexibility when it comes to sending foreign currency.

With Fin.do you can send any currency from any card, regardless of the card’s currency. You can also send any currency to any country, for example USD to Spain or GBP to France.

Instant transfers

Unlike traditional bank transfers, which can take several days to complete, Fin.do delivers transactions instantly, even on weekends or holidays.

No need for bank / card details

International bank transfers are notoriously frustrating to set up, as they require a lot of information such as IBANs and SWIFT codes.

With Fin.do, all you need is your recipient's 16-digit card number.

In addition, sending from a digital wallet (Apple Pay or Google Pay) eliminates the need to add your own cards to your Fin.do account.

Summary

Selecting the best way to send money from the USA to Europe depends on many factors, including transfer speed, cost, and flexibility to transact different currencies.

Always make sure to evaluate fees, exchange rates, and transfer times to ensure you get the best option based on your requirements.

For instant transfers with low fees and complete control over the currencies you send, Fin.do is your best choice.

Get started with Fin.do here.